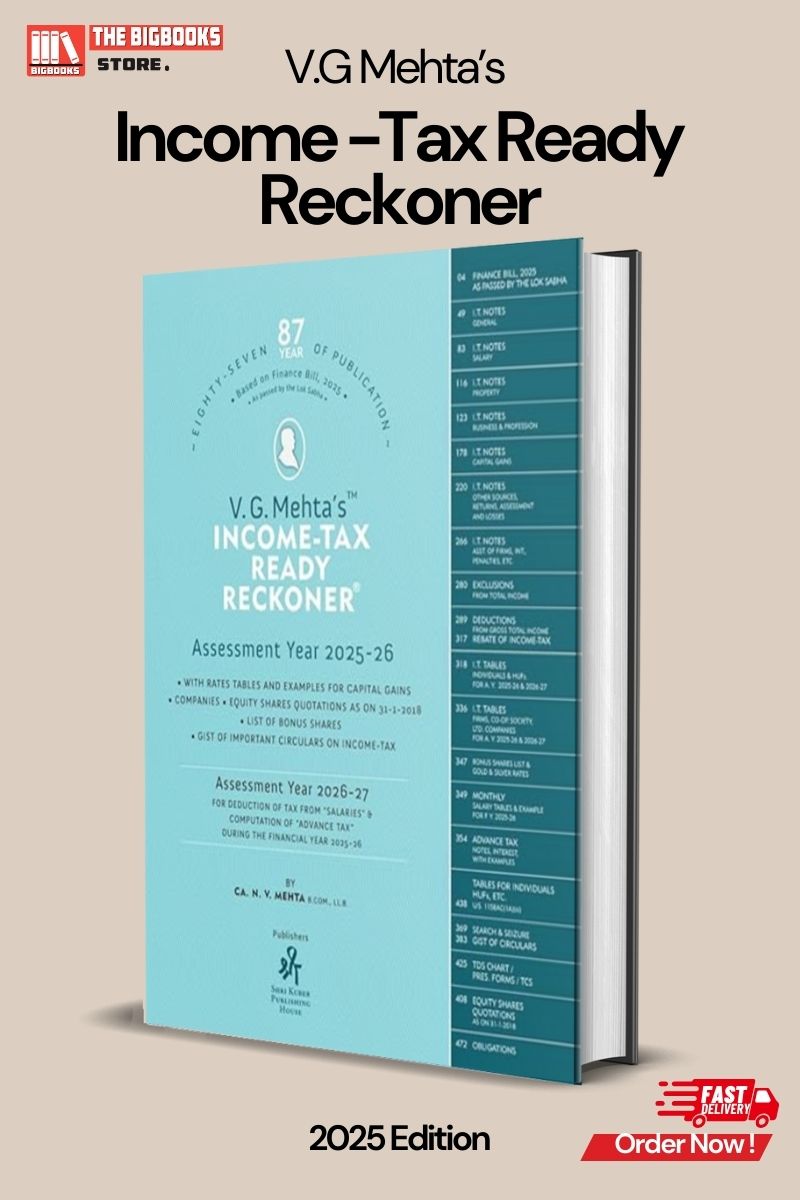

V.G. Mehta's Income Tax Ready Reckoner (DTRR)- A.Y. 2025-26

| Author : | V.G Mehta, CA N.V. Mehta |

|---|

500

English

2025

Tags: Direct and Indirect Taxation, Direct Taxes Ready Reckoner, Income Tax, New Finance Act, 2025-2026, Income Tax Rules

V.G. Mehta’s Income Tax Ready Reckoner (DTRR) – 87th Edition, 2025

V.G. Mehta’s Income Tax Ready Reckoner (DTRR) – 87th Edition, 2025 is a comprehensive and up-to-date guide for tax professionals, businesses, and individuals. Covering Assessment Years 2025-26 and 2026-27, this book provides a detailed analysis of direct tax provisions, tax computation, deductions, and compliance requirements. Published by Shri Kuber Publishing House, this ready reckoner simplifies income tax laws and serves as a quick reference for accurate tax calculations.

Key Features:

✔ Latest Edition (2025) – Covers all amendments and updates introduced by the Finance Act, 2025 for A.Y. 2025-26 & 2026-27.

✔ Quick & Accurate Tax Computation – Provides ready-to-use tax tables, slab rates, and detailed explanations of tax provisions.

✔ Covers All Key Tax Provisions – Includes income tax, TDS/TCS, capital gains, exemptions, deductions, GST impact on taxation, tax audits, and more.

✔ Illustrative Examples & Case Laws – Features practical illustrations, worked-out solutions, and legal precedents to clarify tax concepts.

✔ Easy Reference Format – Designed for tax consultants, accountants, and business owners for quick lookup of tax rates, rules, and provisions.

✔ GST & Taxation Impact – Discusses the latest GST amendments and their impact on income tax compliance and business transactions.

Why Choose This Book?

• Authoritative & Reliable – Written by V.G. Mehta, a trusted expert in taxation and direct tax law interpretation.

• Essential for Tax Professionals & Businesses – A must-have reference for chartered accountants, tax consultants, business owners, and finance professionals.

• Up-to-Date & Practical – Ensures you stay compliant with the latest tax laws and regulatory changes.

• Designed for Quick Consultation – Organized with tables, flowcharts, and structured summaries for efficient tax planning.

Who Should Read This Book?

• Tax Consultants & Chartered Accountants – For accurate tax planning, compliance, and advisory.

• Finance Professionals & Business Owners – To stay updated on income tax regulations and deductions.

• Lawyers & Tax Practitioners – Specializing in direct tax litigation and advisory.

• Students & Competitive Exam Aspirants – Preparing for CA, CS, CMA, LLB, and taxation-related exams.

Conclusion:

V.G. Mehta’s Income Tax Ready Reckoner (DTRR) – 87th Edition, 2025 is an indispensable guide for anyone dealing with income tax laws, tax computations, and financial compliance. With up-to-date amendments, illustrative examples, and easy-to-use reference tables, this book ensures accurate tax calculations and regulatory adherence.

Stay ahead in taxation and financial planning—get your copy today!