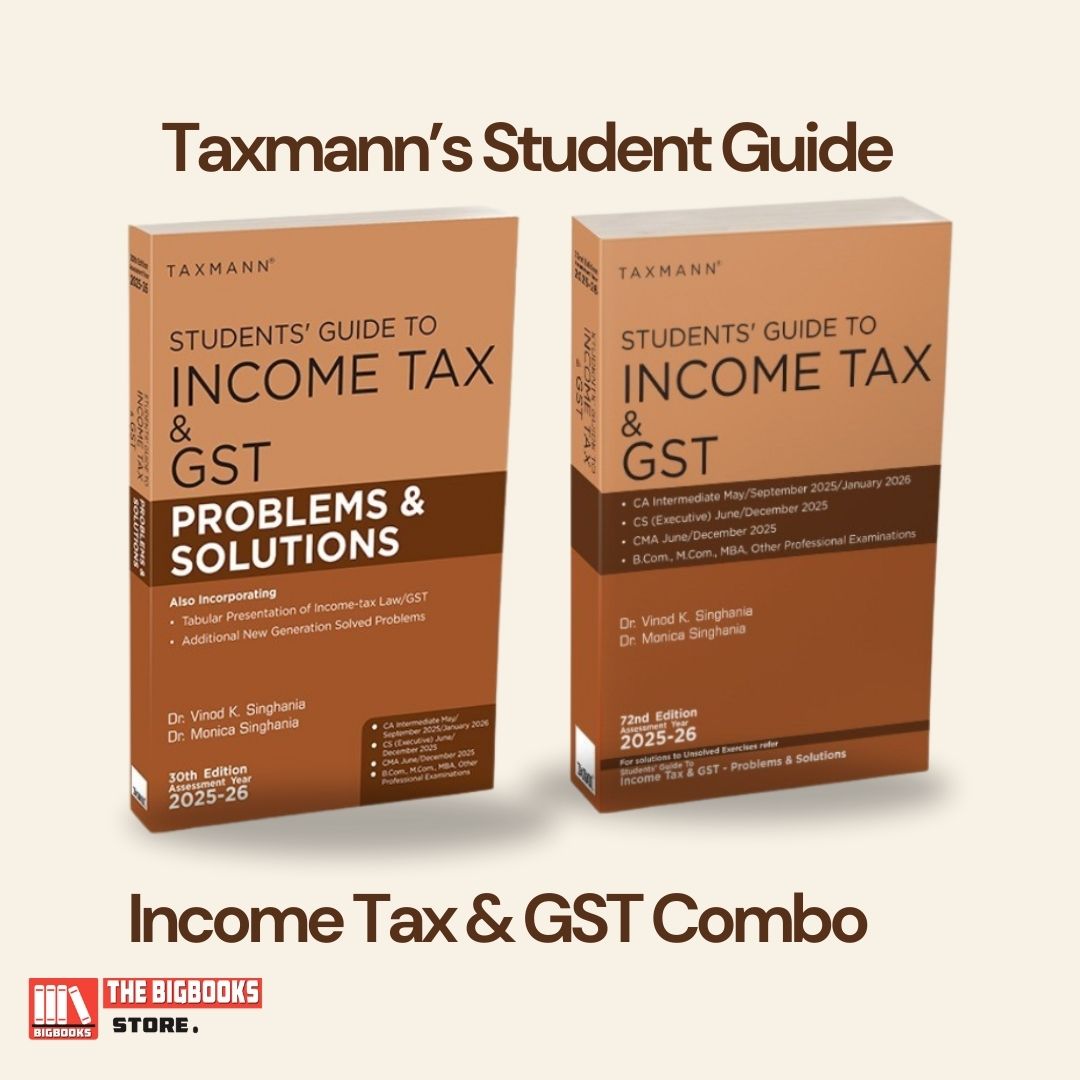

Taxmann's Students’ COMBO Guide to Income Tax & GST (The Comprehensive Theory & Practice) - Edition 2025

| Author : | TAXMANN`S, Vinod K. Singhania |

|---|

Tags: • TAXATION, CA, Income Tax, GST Books, Income Tax, Budget Edition 2025

The Combo offers a balanced blend of theoretical clarity and intensive practice. The first book lays down the conceptual groundwork of taxation (Income Tax & GST) in a simplified, step-by-step manner; the second complements this foundation by providing solutions to complex problem sets and unsolved exercises, reinforcing learning through practice. Each book adopts a student-centric methodology. With exam-oriented discussions, case studies, solved examples, and numerous practice questions, this Combo ensures you gain both conceptual clarity and practical problem-solving skills—vital for excelling in professional examinations.

The Combo is designed for a diverse audience, including undergraduate and postgraduate students (B.Com., BBA, M.Com.) seeking a comprehensive understanding of Income Tax and GST fundamentals with extensive examples to clarify complex provisions. It also caters to professional aspirants such as CA, CS, and CMA candidates. It provides tailored content that meets rigorous examination demands, featuring unique pointers, past exam questions, and in-depth problem-solving methods.

“Taxmann’s Students’ COMBO Guide to Income Tax & GST (The Comprehensive Theory & Practice) - Edition 2025” is an all-encompassing resource tailored for students aiming to master the intricacies of Income Tax and Goods & Services Tax (GST) in India. Authored by Dr. Vinod K. Singhania and Dr. Monica Singhania, this two-book combo is meticulously updated to reflect legislative changes up to December 15, 2024.

Key Features:

• Holistic Learning Approach: The combo integrates both theoretical concepts and practical applications, providing a balanced understanding of Income Tax and GST.

• Student-Centric Presentation: Utilizes a step-by-step methodology with numbered paragraphs and point-wise recaps to facilitate easy comprehension.

• Extensive Practice Material: Offers over 500 solved examples and an equal number of unsolved exercises, enhancing problem-solving skills and exam readiness.

• Exam-Oriented Content: Incorporates past examination questions from professional courses like CA Inter/IPCC, along with unique pointers tailored for such exams.

• Dedicated Problems & Solutions Guide: The accompanying guide provides structured solutions, a three-tier practice format, and realistic exam-style problem-solving techniques.

This comprehensive combo is an indispensable tool for undergraduate and postgraduate students (B.Com., BBA, M.Com.) and professional course aspirants (CA, CS, CMA), ensuring a thorough grasp of both Income Tax and GST.