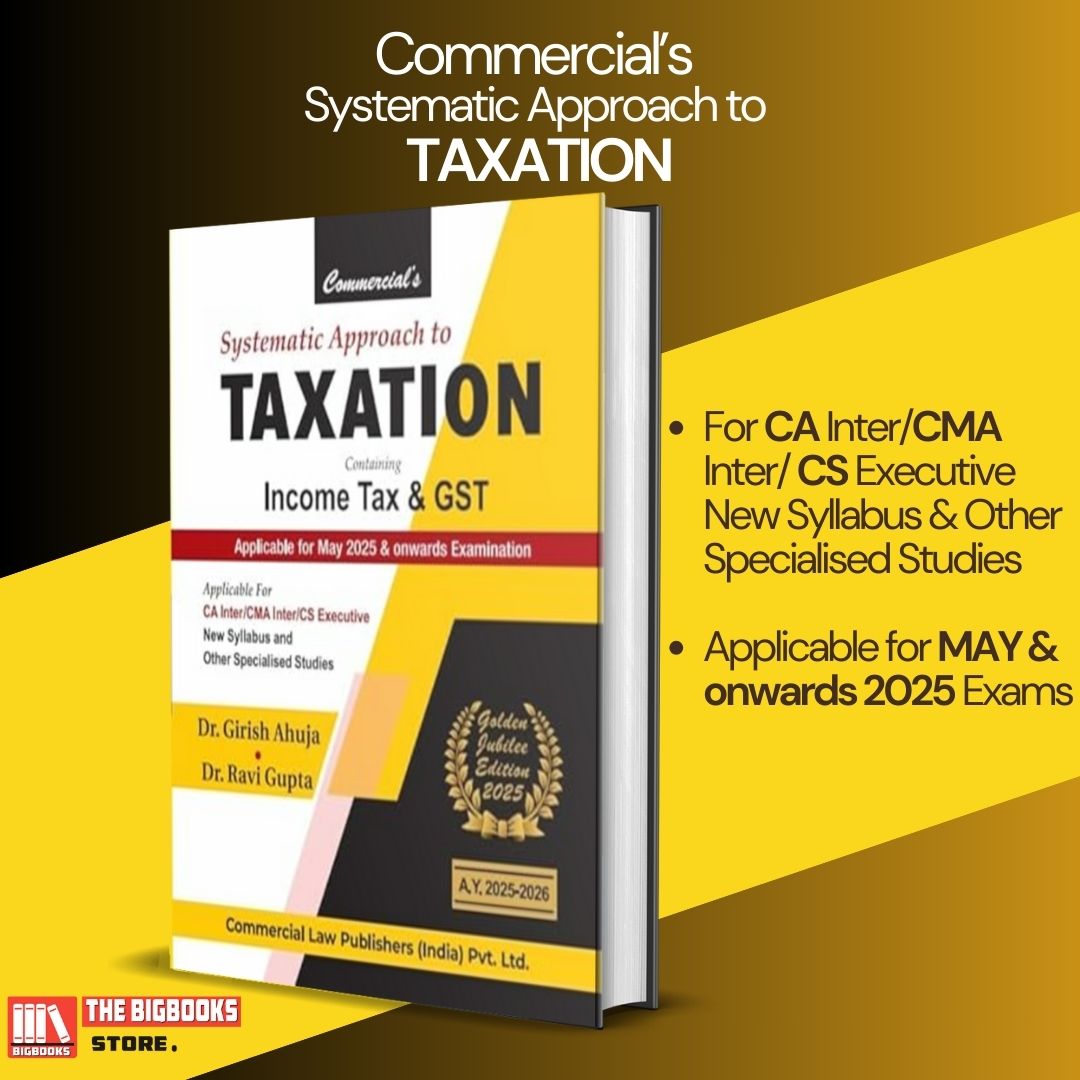

Systematic Approach to Taxation Containing Income Tax & GST (For Applicable for May 2025 & Onwards Eaxmination)- Golden Jubilee Edition 2025

| Author : | DR. GIRISH AHUJA, DR. RAVI GUPTA |

|---|

1105

English

Golden Jubilee Edition 2025

Tags: CA, • CA INTERMEDIATE, • CS EXECUTIVE NEW, • CMA Inter, Taxation, Income Tax, GST Books, Income Tax

Systematic Approach to Taxation – Containing Income Tax & GST | Golden Jubilee Edition 2025

(Applicable for May 2025 & Onwards Examinations)

“Systematic Approach to Taxation” is a comprehensive and exam-focused guide covering both Income Tax and Goods & Services Tax (GST). This Golden Jubilee Edition (2025) is designed for students preparing for CA, CS, CMA, B.Com, M.Com, MBA (Finance), and other taxation-related exams, providing a structured and easy-to-understand approach to taxation concepts.

This edition is fully updated as per the Finance Act, 2024, incorporating the latest amendments, case laws, and practical applications of tax laws. It presents complex tax provisions in a systematic and student-friendly manner, making it easier to grasp both direct and indirect taxes.

The book follows an exam-oriented approach, featuring:

✅ Detailed explanations of Income Tax and GST provisions with step-by-step analysis.

✅ Solved and unsolved numerical problems to strengthen practical understanding.

✅ Previous years’ examination questions for CA, CS, CMA, and university-level exams.

✅ Chapter-wise summaries and revision notes for quick last-minute preparation.

✅ Case laws and practical scenarios to enhance conceptual clarity.

This book is an essential resource for self-study and professional reference, ensuring that students and professionals stay updated with the latest taxation concepts. Its simplified approach, structured format, and practical problem-solving techniques make it a must-have for excelling in taxation exams.

📚 Master Income Tax & GST with confidence and clarity!

🛒 Order now on The BigBooks Store! 🚀

![Commercial's Practical Guide On TDS and TCS – 24th Edition 2025 [As Amended by The Finance Act, 2025] Commercial's Practical Guide On TDS and TCS – 24th Edition 2025 [As Amended by The Finance Act, 2025]](uploaded_files/product/1744426611.jpg)