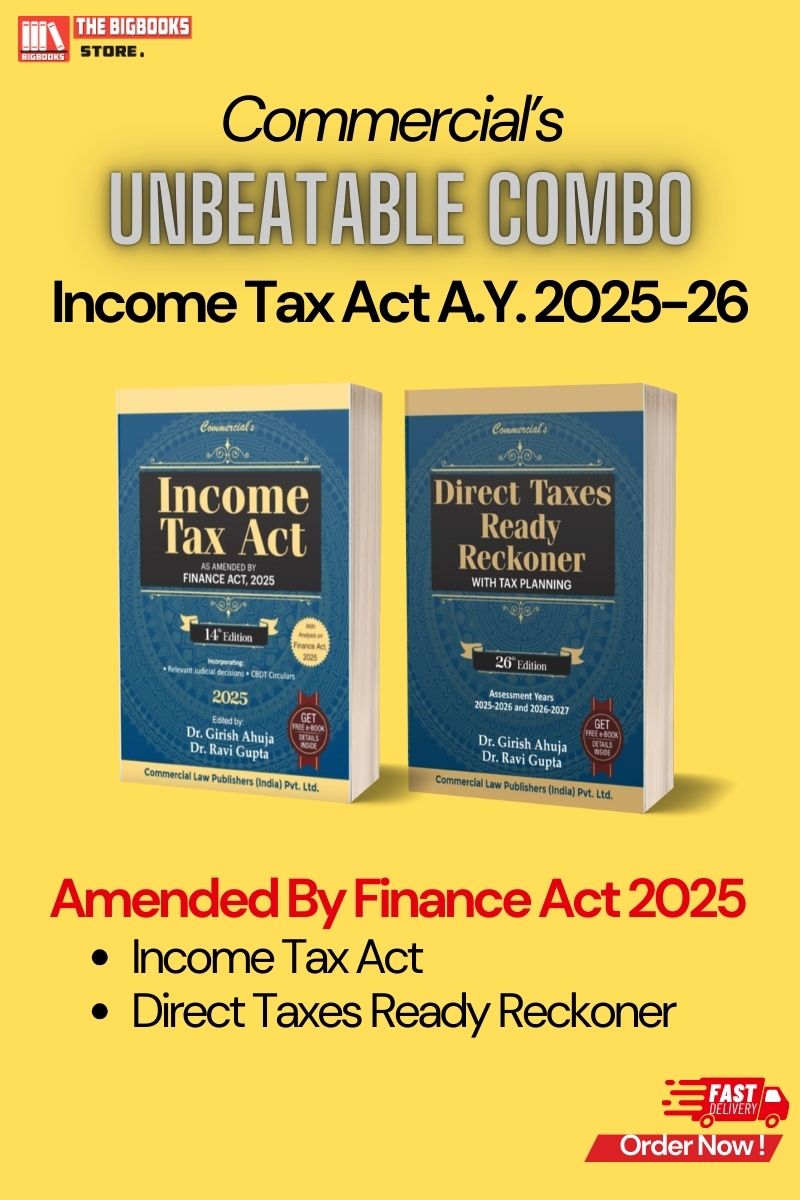

Commercial Combo of 2 - Income Tax Act (A.Y. 2025-26) & Direct Taxes Ready Reckoner Amended By Finance Act 2025

Tags: Direct and Indirect Taxation, Direct Taxes Ready Reckoner, Income Tax, New Finance Act, 2025-2026, Income Tax Bill, Income Tax Rules

Commercial Combo of 2 - Income Tax Act (A.Y. 2025-26) & Direct Taxes Ready Reckoner Amended By Finance Act 2025

Description

The Commercial Combo of 2 includes the Income Tax Act (A.Y. 2025-26) and the Direct Taxes Ready Reckoner, both updated with the Finance Act, 2025 amendments. This combo is perfect for professionals and businesses needing the most up-to-date resources for income tax planning, filing, and compliance. It provides a comprehensive and easy-to-use guide to ensure compliance with the latest tax provisions, case laws, and rules.

Combo Includes:

1. Income Tax Act (A.Y. 2025-26) – A detailed guide covering the latest amendments to the Income Tax Act, including key provisions, sections, and taxation rules.

2. Direct Taxes Ready Reckoner (Amended by Finance Act, 2025) – A practical guide for quick reference to all direct tax provisions, important rules, and key case laws for tax professionals and corporates.

This combo is essential for professionals looking to stay on top of direct tax laws and streamline their tax planning and compliance efforts.

Key Features:

• Updated with Finance Act, 2025 – Includes all the latest amendments for A.Y. 2025-26.

• Comprehensive Coverage – Covers Income Tax Act provisions, sections, and rules in detail.

• Direct Taxes Ready Reckoner – A quick reference guide for tax professionals to understand key tax regulations.

• Easy-to-Use Format – Designed for professionals who need quick access to essential tax information.

• Ideal for Tax Consultants – Perfect for CAs, tax consultants, corporate advisors, and anyone involved in income tax filings.